Recent

Graph Theory - Epidemic Outbreak

Amid the outbreak of the novel corona virus, we have observed a bonanza of agent-based simulation in epidemiology. By leveraging the probability generating function of a random graph, whether it is Barabási-Albert model following power-law distribution or Erdős–Rényi model following Poisson distribution, we are able to consume the least computing power to estimate the prevalence and the duration of COVID-19.

Machine Learning - Wisdom of Crowds

Every now and then, we read some bulge brackets hit the headline, “XXX will reach 99999€ in 20YY”. Some forecasts hit the bull’s eye but most projections are as accurate as astrology. Price prediction can be easily influenced by the cognitive bias. In the financial market, there is merit to the idea that consensus estimate is the best oracle. By harnessing the power of ensemble learning, we are about to leverage Dawid-Skene model and Platt-Burges model to eliminate the idiosyncratic noise associate with each individual judgement. The end game is to reveal the underlying intrinsic value generated by the collective knowledge of research analysts from different investment banks. Is wisdom of crowds a crystal ball for trading?

Machine Learning - Reverse Engineering

Creating a visualization from data is easy. In Tableau, it's only one click. What happens if you want to extract data from a visualization? A simple google search yields a few reverse engineering tools, yet they share the same malaise – they only work with single curve and require a lot of clicks. This project addresses these issues by incorporating unsupervised learning into image processing. Data can be easily extracted via one click. Voila, no more ridiculous subscription to Statista 😲

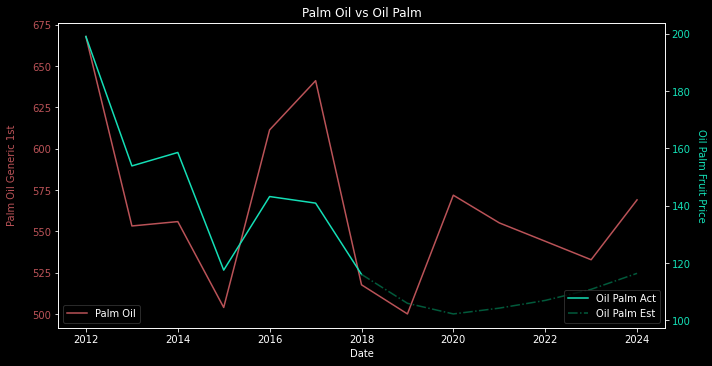

Quant Trading - Smart Farmers

🍊 🍍 🍈 🌽 and 🍠 are something we have been taking for granted. Up until COVID-19, we finally come to senses that farmers are one of our low-paid essential workers. This project is dedicated to the optimal allocation of agricultural resources. By trading agricultural market, we are able to eliminate the inefficiency in the crop market. Ideally no food will be wasted and farmers will be fairly compensated.

Quant Trading - Oil Money

This project is inspired by an article on oil-backed foreign exchange. Amid the bullish outlook for crude oil, the currency exchange of oil producing countries would also bounce back. But, does this statement really hold? With academic analysis and computer simulation on a couple of petrocurrencies, we have found a deeper level of the story.

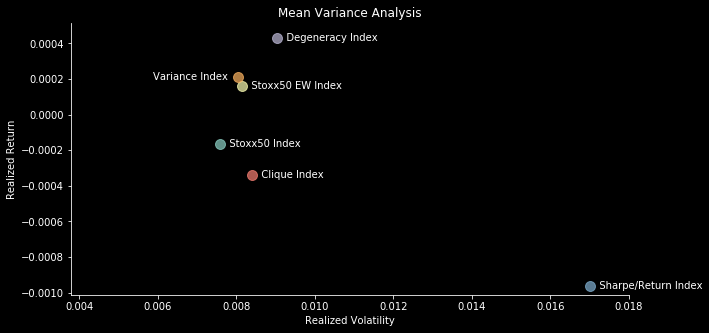

Graph Theory - Portfolio Optimization

Modern portfolio theory was introduced in 1952 by Nobel laureate Harry Markowitz. It is part of investment class 101. But I watched a video by Wolfram recently. It challenged the traditional approach and introduced graph theory to asset diversification. There are plenty of quant shops deploying fancy mathematic tools to solve the market. The real question for us is, as fancy as it sounds, does graph theory work on portfolio optimization?

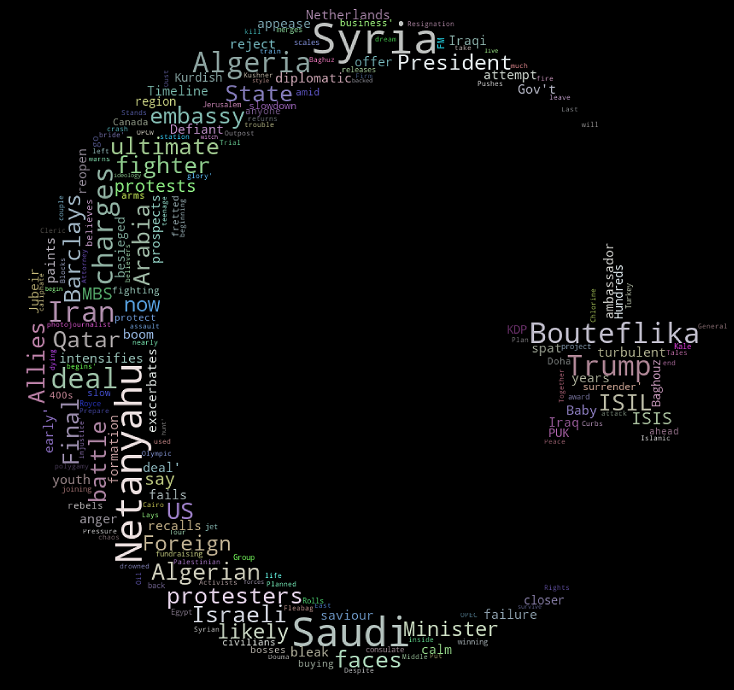

Graph Theory - Text Mining

Is machine learning the best solution to text mining? What if graph theory beats it in both time and space complexity?

This project is designed for MENA Newsletter. The idea is to use graph structure traversal algorithm to remove similar contents and extract key information from the metadata of text.

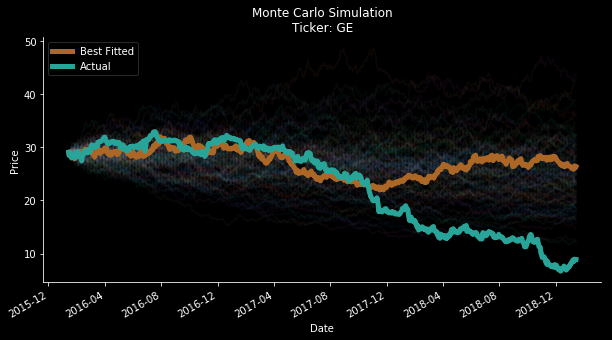

Quant Trading - Monte Carlo

Monte Carlo, the name actually refers to the computer simulation of massive amount of random events. This unconventional mathematical method is extremely powerful in the study of stochastic process. If we consider stock price as a Wienner Process, can we use Monte Carlo simulation to predict the stock price, even a range or its direction?

Upcoming

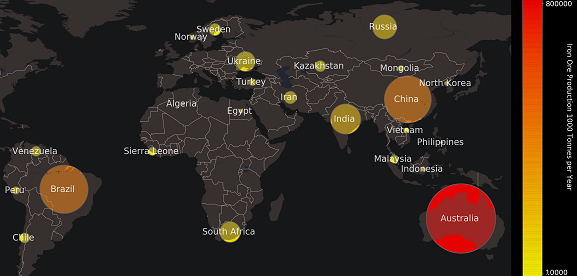

Quant Trading - Ore Money

This is an upcoming project, an upgraded version of oil money trading strategy with introduction of more sophisticated models and alternative datasets. The project will examine the causality between iron ore spot price and forex of iron ore exporting countries. If the project can replicate the success of oil money trading strategy, we shall be able to apply it to the currency of any major natural resource exporters and correlated commodity contracts.

Stay Tuned.

About T.M.

Half Researcher, Half Developer.

Data Scientist, Pseudo Artist, Cunning Anecdotist.

Always Generous, Humorous and Adventurous.

I have deep enthusiasm for mathematical modelling.

I firmly believe in using computer science to solve practical problems in the world.

If you have any questions or thoughts, do not hesitate to raise issues in my GitHub repository so we can start discussion.

I genuinely enjoy conversations with people from diverse background.

They never stop to inspire me to develop new perspectives to tackle challenges in life.

Skills including, but not limited to

- Algorithmic Trading

- Agent-based Simulation

- Bayesian Statistics

- Complex Network

- Convex Optimization

- Dynamic System

- Graph Theory

- Machine Learning

- Natural Language Processing

- Operations Research

- Time Series Analysis

Strength in

- Data Engineering

- Data Modelling

- Data Visualizing

- Data Storytelling